COVID-RENT Program

The eligible applicant is the tenant who:

- is an entrepreneur (natural or legal person) and carries out business activities, uses an establishment which is not owned by him, on the basis of a lease agreement concluded before 13 March 2020, for the retail sale of goods or the provision of services to customers

- as a result of the emergency measures taken in connection with the COVID and 19 pandemic, he was banned by the authorities from retailing goods or providing services to customers on premises for at least part of the period from 13 March to 30 June 2020

- is not a related person with the landlord of the premises.

- Granting of a discount by the landlord of at least 30% of the decisive rent.

- Payment of at least 50% of the decisive rent by the aid applicant before submitting the application.

The amount of support is 50% of the decisive rent.

- The establishment is located in real estate owned by the state and a 30% discount on rent cannot be provided.

The amount of support is 80% of the decisive rent.

Important information for foreigners who want to come to the Czech Republic

New confirmation required

Document entitled Confirmation of an entity receiving in the territory of the Czech Republic a third country citizen for the purpose of economic activity or educational activity will be from 13.7. require when applying for visas and stays for the purpose of economic or educational activities, which will be submitted through embassies (copies will suffice). And it will be required even if you submit application earlier, but you are still waiting for issuing a visa. The document can be downloaded here: VZOR-potvrzeni_prijimajiciho_subjektu_na_uzemi_CR_cizince_ze_3_zeme_CZ-EN_-_20200630

Covid-19 test

After arriving in the Czech Republic from the People's Republic of China or another country located in the red zone, ie in the zone with a high incidence of Covid-19, you are now required to report to a hygiene station (immediately upon arrival) and take an RT-PCR test in Covid-19 in the Czech Republic, NO LATER THAN 72 HOURS FROM ARRIVAL, and the result will be then communicated to the hygiene. You must be quarantined until the negative result.

Conditions for visiting Ministry of Interior offices from July 1st, 2020

After your arrival or return to the Czech Republic, wait with the visit of MOI office 14 days due to preventive reasons. Earlier entry to the MOI office will be possible only after submission of SARS CoV-2 test with negative result.

Access to the MOI office is still possible only on the basis of previously pre-bookedappointment.

VISIT WITHOUT ARRANGING YOUR APPOINTMENT IN ADVANCE will be possible only for acts, which cannot be postponed:

- Issuing of the bridging label for traveling abroad from the Czech Republic, for workers in international transport, workers of critical infrastructure or for requirements of state authorities of the Czech Republic. Purpose must be proven.

- Take-over of the document delivered by public notice.

- Issuing of departure order, if period for traveling abroad from the Czech Republic was determined by decision.

- Submission of application for long-term visa, long-term residence permit or permanent residence permit for child born in the territory of the Czech Republic (§ 88 of the Act on the Residence of Foreign nationals in the Czech Republic).

- If foreign national was previously invited by administrative authority.

Information regarding departure of foreigners from the Czech Republic to July 16th, 2020

Foreign nationals (third-country nationals) whose current residence permit in the Czech Republic has expired after March 12th, 2020 must leave the territory of the Czech Republic by July 16th, 2020 at the latest. For this period, the exit order for foreign nationals will not be issued.

To ensure easier passage through other member states of the European Union, the Police of the Czech Republic marks the special stamp on the travel document. This stamp certifies the tolerance of the foreign national`s stay in the Czech Republic for the purpose of informing other Member States of the European Union in the event of transit through their territory. However, the stamp does not provide automatic entry into the territory of these states.

If you are leaving the territory of the Czech Republic, it is recommended to come to the nearest Department of Residential Agendas of the Foreign Police before departure during office hours to ask for the stamp.

Attention - the stamp is only used for exit. After marking the stamp, leave the territory of the Czech Republic within 24 hours, otherwise you are exposed to an increased risk of punishment by other Member States of the European Union, through which you will transit.

Foreign nationals (Third-country nationals) with

- short-term visa for the purpose employment

- short-term visa for the purpose seasonal

- visa for a stay of over 90 days for the purpose seasonal, or

- special work visa,

which the validity of visa ended after March 12th, 2020 and employer arranged extension of employment relationship or new employment relationship, the travel period is extended up to September 16th, 2020

This information in Chinese:

2020 年 3 月 12 日以后临时居留有效期结束的外国人(第三国家国民)必须不迟于 2020 年 7 月 16 日离开捷克共和国。这期间,将不会向外国人发出出境命令不。

为了确保更轻松地通过欧盟其他成员国捷克共和国警察盖上特殊图章来确认旅行证件。 在确保更轻松地通过欧盟其他成员国情况下,特殊图章将外国人在捷克共和国逗留的 容忍度通知欧盟其他成员国。但是,该特殊图章并未规定自动进入这些州的领土。

要是您出去捷克共和国领土的话,离开捷克领土以前就要办公时间申请最近外事警察 处理居留手续局盖上特殊图章来确认旅行证件.

注意:特殊图章仅用于出去捷克共和国领土。盖上特殊图章来确认旅行证件后 24 小时 之内就出去捷克共和国的领土,否则您将受到欧盟其他成员国的惩罚,这将使您受到 惩罚的风险增加。

外国人(第三国国民): •以就业为目的的短期签证 •季节性短期签证 •季节性停留签证超过 90 天, •非常规工作签证,

签证在 2020 年 3 月 12 日之后到期,并且雇主与外国人(第三国国民)协商延长雇佣关系或新 的雇佣关系,旅行期限延长至 2020 年 9 月 16 日;同时,工作许可证的有效期也在延长(此处 有详细信息-参照政府第 685/20 号决议,针对世界流行病学情况采取措施)。

Important notices - Ministry of Interior

Government of the Czech Republic approved partial release of entry to the Czech Republic for Third-country nationals with effectiveness from 11 May 2020.

1. From that term, entry to the Czech Republic will be enabled to foreign nationals to whom residence was allowed, but they did not take over residence permit (i.e. arrival will be enabled on a visa for the purpose of collecting a residence permit – D/VR).

2. Third-country nationals of selected professions and selected industries will be allowed to arrive:

a) seasonal workers especially in agriculture (foreign nationals to whom short-term visa for the purpose seasonal work was issued, long-term visa for the purpose of seasonal work, extraordinary work visa)

b) key workers and their family members (foreign nationals who submitted their application within government KEY AND RESEARCH STAFF PROGRAMME)

c) workers in healthcare and social services and their family members (foreign nationals with short-term visa for the purpose of employment issued after 11 May 2020; foreign nationals who submitted their application within government HIGHLY QUALIFIED WORKER PROGRAMME or QUALIFIED WORKER PROGRAMME)

In this context, application procedure of residence permits submitted within government programmes of economic migration, applications of long-term visa for the purpose of employment and extraordinary work visas will be restarted from 11 May 2020.

All written above applies under the condition, that the country enables opening (submitting applications and performing acts within procedure) embassy, in connection with measure implemented due to pandemic COVID-19.

Warning: All foreign nationals will be obliged to submit the medical certificate of negative completion of the RT-PCR test for the presence of SARS-CoV-2 upon entry into the territory of the Czech Republic supplemented by the certificate from the relevant laboratory, otherwise it is not possible to enter the territory. This does not apply to exceptions.

Situation of foreign nationals and the legality of their stay after the end of the state of emergency

In connection with the COVID-19 pandemic the state of emergency was declared in the Czech Republic from March 12th, 2020 and will probably end on May 17th, 2020.

1) Foreign nationals, who were in the Czech Republic legally at the time of the declaration of the state of emergency, were allowed to stay in the Czech Republic for the duration of the state of emergency, even if their residence permit expired.

After the end of the state of emergency, foreign nationals will not be sanctioned for staying in the Czech Republic without a valid residence permit for another 60 days. At this time, they do not even have to deal with the expired validity of the stay at the offices of the Ministry of the Interior or the Police of the Czech Republic. However, they are obliged to leave the Czech Republic during these 60 days!

In order to ensure a smooth return of foreign nationals to the country of origin, the legality of their stay will be certified during border control by the special stamp in the travel document at the time of departure from the Czech Republic. The Czech Republic informed all states about this procedure.

To facilitate smooth return this certificate of legality of stay in the form of the stamp in the travel document will be introduced from Monday, May 4th, 2020. The stamp does not ensure entry into the territory of other states.The possibilities of transit are always determined by their own measures.

2) If you work in the Czech Republic and you are holder of employee card, you can from March 19th, 2020 change your employer or your job position before the end of the state of emergency and you do not have to finish 6 months period. You are still obliged to report the change to the Ministry of the Interior according to the legal conditions.

Covid-19 and self-employed person (OSVČ)

School closure – since 11th of March to unknown date

The Ministry of Healthcare has banned the students from entering the schools and children from entering the kindergardens.

Link

Shops closure – since 14th of March, 6:00 to 11th of April, 6:00 (period may be extended)

The government ruled to close all stores except grocery stores, pharmacies, drugstores, petrol stations and some others. This also applies to services such as hairdressing and beauty salons.

Suspension of EET for an emergency period of three months

Electronic sales records will be suspended for the period of declared emergency and the following three months. Thus, no entrepreneur will have to record his sales and the authorities will not check this obligation. (Act No. 137/2020 Coll.)

1) Submission of an overview for 2019

An overview of income and expenditure for 2019 can be submitted by a self-employed person without sanctions until 3 August 2020. If the self-employed person also pays the insurance surcharge on this date, he will be remitted a penalty that would otherwise have to pay for late payment.

2) Forgiveness of social insurance

From March to August self-employed persons will not have to pay the prescribed backups and in their annual accounts, their total insurance will be reduced by the amount corresponding to the minimum pension backups for half a year. The period from March to August continues to count towards pension entitlements.

How will this work in practice?

Traders do not have to request anywhere. The change applies automatically. It is applies for everyone (self-employed with main and secondary gainful activity).

Does this mean that I do not pay any compulsory social security contributions at all?

The only payment will be the payment of sickness insurance for voluntarily insured self-employed persons. The differences will be in the 2020 billing:

- Do you pay minimum advances? You are fully forgiven for the mandatory pension insurance payments for March to August.

- Do you pay more than minimal advances? From March to August you do not have to pay any deposit. However, in the next year's annual billing, you will only pay back the difference between the minimum deposit and the actual premium according to your 2020 profit for these 6 months.

By when do I have to pay the deposit difference next year?

You will pay the difference in advance as a supplement to the insurance premium after submitting an overview of income and expenses of self-employed persons for the year 2020.

3) The Care Benefit for self-employed person

- Applicant:

- Self-employed persons who were not able to carry out self-employment for a certain period due to measures against the spread of coronavirus infection and care for a child under 13 years of age or handicapped person (similarly as for employees of the Czech Republic - school facilities or facilities for handicapped persons are closed), which is supported by conclusive documents. Provided that no other person receives the care benefit or other allowance for the same child.

- Self-employed in main activity - proves by affidavit

- Must be registered as a tax payer with the tax office - proves by affidavit

- Must be a small or medium sized entrepreneur - proves by affidavit

- Shall not have any arrears to the Tax Office, the Czech Social Security Administration or the health insurance company - proves by affidavit

- Application: HERE

- Provider: Ministry of Industry and Trade

- The objective of the aid is a financial contribution to compensate the self-employed with measures against coronavirus - nursing a family member - of CZK 424 per day for up to 13 144 CZK per month.

- The Care Benefit is requested for each calendar month. The subsidy will be sent to the self-employed bank account specified in the application.

- The Care Benefit will be able to draw all the time, as long as the emergency measures apply.

How to apply?

Phase 1: Starting date for receipt of applications: 1 April 2020 at 9.00

End of applications: 30/04/20 to 23:59

Allocation per phase: CZK 100 million

1. The applicant shall complete the application for a subsidy in a simple form in the Czech language. HERE

2. The applicant shall submit an application, including attachments, to the Ministry of Industry and Trade:

- Via the data box wnswemb, to introduce fpmpo20 into the subject, or

- By e-mail, whose attachment will be a completed electronic signature form including

attachments to fpmpo20@mpo.cz and include fpmpo20 in the subject, or

- Original application signed by the applicant by post to: Ministerstvo průmyslu a obchodu,

Na Františku 32, 110 15 Praha 1, the envelope must be labeled "fpmpo20".

3. Required annexes to the application for the Care Benefit are:

- Application form / affidavit

- Confirmation of closure of school facility or facility for handicapped person

4) Interest-free loans

- COVID I loan with one-year postponement of installments:

- Receipt of applications has been suspended

- https://www.cmzrb.cz/podnikatele/uvery/uver-covid/

- COVID II loan with one-year postponement of installments:

- Start at CZK 10,000 and end at CZK 15 million

- We expect the launch of COVID II on Monday 30.3.2020

- https://www.cmzrb.cz/cmzrb-rozdeli-dalsich-5-miliard-na-covid-ii/

- The Ministry of Industry and Trade is preparing the COVID III program (Link)

5) Interruption or termination of self-employment and records at the Labor Office of the Czech Republic

Can I register as a self-employed person at the Labor Office of the Czech Republic?

In order for a self-employed person to be registered with the Labor Office of the Czech Republic, it is necessary to interrupt or terminate business activities. The self-employed person must notify the relevant district social security administration (DSSA) in writing of the suspension or termination of business. Self-employed persons will need confirmation of the periods of participation in pension insurance and the last assessment base for the purposes of the Labor Office of the Czech Republic. The request for this confirmation can be sent (preferably with the request for interruption or termination of business) also by e-mail to the electronic registry of the relevant DSSA. The self-employed person can then be contacted by the DSSA by telephone to verify the authenticity of the submission.

Recommended Action:

- Application - It is recommended to send this notification electronically (directly from the CSSA ePortal, to the DSSA data box or as an e-mail attachment), or by post. The district social security administrations will also accept sending by e-mail without a guaranteed electronic signature.

- If the self-employed person also needs a confirmation of the insurance participation period for the purposes of the Labor Office of the Czech Republic, it is possible to send an application for the confirmation by e-mail to the electronic registry of the relevant DSSA. If the application implies that the confirmation is to be delivered either by post to the permanent address of the self-employed person or directly to a specific Labor Office, the e-mail need not be electronically signed. In other cases, the application must be sent either by data box or with an electronic signature, or it can be physically filled in the box at the relevant district social security administration.

When should I register at the Labor Office of the Czech Republic?

In the register of job seekers, a natural person is entered on the day of submitting (delivery) an application for employment mediation(with this application the application for unemployment benefit is sent) to the Labor Office of the Czech Republic. If the application is submitted no later than three working days after the interruption or termination of self-employment, the natural person is included in the register of job seekers from the day following the interruption or termination of business.

Both completed applications are sent to the workplace of the Labor Office of the Czech Republic in the place of permanent residence of a natural person via a data box or electronically with an electronic signature (performed directly in interactive application forms). If the self-employed person does not have an electronic signature, both completed applications can be sent by e-mail without an electronic signature. In this case, applications must be completed within 5 calendar days (in writing by post or in the mailbox of the Labor Office of the Czech Republic).

What do I need for applications?

- Application for employment mediation:

- document to verify identity, citizenship and place of residence (identity card),

- proof of termination of self-employment

- confirmation of assessment base

- medical restriction document (medical opinion)

- if you are engaged in a non-conflicting job (an activity based on an employment or service relationship where the monthly earnings do not exceed half the minimum wage, or an activity based on an agreement on work activity where the remuneration does not exceed half the minimum wage), it is the duty to report this activity and the amount of remuneration to the Labor Office

- Application for unemployment benefit:

- Confirmation of the duration of participation in pension insurance and the assessment base for social security contributions and contributions to state policy

6) Are self-employed persons entitled to any social benefits?

Everyone has the option of applying for any of the non-insurance social benefits, both for state social support benefits (birth grant, parental allowance, housing allowance) and assistance in material need (subsistence allowance, housing allowance and. extraordinary immediate assistance. The Labor Office of the Czech Republic always proceeds according to valid legislation and assesses each application for a specific benefit or its increase individually. Taking into account the specific situation of the applicant.

The entitlement to the grant and the final amount of non-insurance social benefits are based on the applicant's current income and property situation and on the current amount of housing costs. Thus, it cannot be said in advance whether the entitlement to benefits arises and also the amount of benefits cannot be communicated in advance.

7) Support for small businesses

The Ministry of Finance prepared legislation to support small businesses affected by current anti-pandemic measures - one-off financial assistance of CZK 25,000. In view of the need to adopt the relevant legislation, we expect the measure to be effective in mid-April.

The act was passed by Parliament on Thursday 9 April 2020, bringing the legislative process considerably closer to its final and therefore the Financial Administration has started accepting applications. The support will be available until the end of June.

Requirements:

- Self-employed person by law (independent farmer, author or artist, expert, interpreter, veterinarian, doctor, healthcare provider, architect, tax advisor and the like).

- The activity performed is the main activity.

- The activity performed may also be an ancillary activity if the self-employed person: 1) receives an invalidity or old-age pension 2) is on maternity or parental leave 3) takes care of a disabled person 4) preparing for future career (students)

- The self-employed were active on 12 March 2020. Alternatively, they may also be a self-employed who later activated their activity, provided that their activity was interrupted at any time after 31 August 2019.

- A self-employed person declares that he / she was unable to perform this activity in whole or in part above the normal level due to health threats associated with the occurrence of coronavirus or government emergency measures.

- The applicant shall prove the fulfillment of these facts by a declaration on honor.

How much can I get?

The amount is CZK 25,000, ie CZK 500 for each day that the eligibility criteria are met. If a person does not meet the above condition for some time (eg he / she has not been a self-employed person), the bonus will be reduced accordingly.

Applications will be received by e-mail, post, via data box or through the Electronic Submissions for Financial Administration (EPO) application. The form is available HERE.

No decision is taken on the application. You can recognize the processing of your application by crediting the support to the bank account.

We monitor the situation and update the articles on the website, so follow our website. If you need professional assistance, please contact us.

Covid-19 state measures and employees/employers

School closure – since 11th of March to unknown date

The Ministry of Healthcare has banned the students from entering the schools and children from entering the kindergardens.

Link

Shops closure – since 14th of March, 6:00 to 11th of April, 6:00 (period may be extended)

The government ruled to close all stores except grocery stores, pharmacies, drugstores, petrol stations and some others. This also applies to services such as hairdressing and beauty salons.

Suspension of EET for an emergency period of three months

Electronic sales records will be suspended for the period of declared emergency and the following three months. Thus, no entrepreneur will have to record his sales and the authorities will not check this obligation. (Act No. 137/2020 Coll.)

Covid-19 and employees

1) Employee returned from a territory affected by the coronavirus (quarantine is not ordered)

The employee should, with regard to Article 102(1) and Article 106(4) of the Labour Code, inform the employer that he or she has returned from a territory affected by the coronavirus.

In the absence of a quarantine order or a temporary inability to work, the following tools may be used to prevent further spread and transmission of coronavirus infection:

- The employer can agree with the employee on a temporary work outside the workplace (e.g. homeworking). As it is an agreement, the employee does not have to agree with the work outside the workplace.

- The employer makes a suitable relocation of shifts timetable and informs the employee in time, i.e. at least 14 days before, unless agreed otherwise with the employee.

- The employer has the right to order vacationing BUT the order must be given min. 2 week in advance, unless he makes an agreement with the employee on a shorter period. The length of ordered vacation is not limited, it may be total 20 days of vacation. In this case the employees are entitled to 100 % of average earnings.

- In case the employee is ready to perform work at the workplace and the employer will not give him any work task without a work obstacle on the side of the employee (e.g. the employee does not have an ordered quarantine and is not in temporary work incapability, but the employer only has certain concerns), this situation is considered as a work obstacle on the side of the employer and the employee is entitled to a wage replacement in the amount of the average earnings.

- If none of the measures mentioned above is used in a concrete case, it is possible that the employer agrees upon the request of the employee with provision of leave without a wage replacement.

2) Employee is in an ordered quarantine in the Czech Republic

The public health authority decides upon the order of quarantine, its length and termination, and in this respect it is obliged to inform the employer upon his request that the quarantine has been ordered to an employee. In case an ordered quarantine, it is considered as a work obstacle on the side of the employee, when he is entitled to a wage replacement, equally like in case of temporary work incapacity.

- The employee has the right to compensation of wage / salary from the employer for the period of the first 14 calendar days of the ordered quarantine. Wage / salary compensation is equal to 60% of reduced average earnings. Subsequently, if the ordered quarantine lasts more than 14 calendar days, the employee is entitled to a sickness insurance benefit - sickness benefit paid by DSSA. According to the approved Targeted Employment Support Program, wage compensation paid to employers will be 80% - MODE A*.

- If a quarantine employee complies with all set restrictions and health condition of the employee allows, it is possible for the employee to agree with the employer to work from a place other than the employer's workplace (usually from home).

- The employer cannot order the employee to order vacationing for a period of quarantine unless the employee so requests. If an employee has started to take vacation before being quarantined, ordered quarantine does not interrupt the vacation.

3) Opportunities for employers to save on employee wage/salary

- No action scenario: The employees are entitled to salary compensation equal to their average earnings if they do not work.

- The Care Benefit scenario – parents caring for children under the age of 13 or handicapped person - see below

- The employer has the right to order vacationing BUT the order must be given min. 2 week in advance, unless he makes an agreement with the employee on a shorter period. The length of ordered vacation is not limited, it may be total 20 days of vacation. In this case the employees are entitled to 100 % of average earnings.

- The employer and employees can agree to a special regime. This may even be an unpaid leave for employees, if they agree.

- Failure to allocate work due to input outages (supplies of raw materials, services, components, documents) – wage compensation for employee is at least 80% average earnings. According to the approved Extended Employment Support Program, if the requirements are met, wage compensation paid to employers will be be 60% - MODE B*.

- Failure to allocate work to the remaining employees due to the absence of 30%+ employees (e.g. quarantine, childcare) - wage compensation for employee is 100% average earnings. According to the approved Extended Employment Support Program, if the requirements are met, wage compensation paid to employers will be 60% - MODE B*.

- Temporary closure or restriction of operations as a result of emergency measures taken under the Crisis Act (gym, restaurant etc.) – see below

- Temporary closure or restriction of operations as a result of a reduction in demand for services rendered or a reduction in product sales – see below

4) What is the salary of an employee if there is a temporary closure or restriction of operations as the result of the emergency measures taken under the Crisis Act (eg in connection with government resolutions - gyms, clothing stores, restaurants)?

2 options:

- 208 LC - other obstacle to work on the part of the employer = wage / salary compensation of 100 % average earnings. According to the approved Targeted Employment Support Program, if the requirements are met, wage compensation paid to employers will be e 80% - MODE A*.

- If demand/sales are limited and an agreement is reached with a trade union or an internal regulation is issued, partial unemployment can be applied = wage compensation of at least 60% average earnings.

5) What is the salary of an employee if there is a temporary closure or restriction of operations as a result of a reduction in demand for services rendered or a reduction in product sales?

2 options:

- 208 LC - other obstacle to work on the part of the employer = wage / salary compensation of 100 % average earnings.

- An agreement is reached with a trade union or an internal regulation is issued, partial unemployment can be applied = wage compensation of at least 60% average earnings According to the approved Extended Employment Support Program, if the requirements are met, wage compensation paid to employers will be 60% - MODE B*.

* When should the employer claim compensation?

The antivirus program will run from April 6. From then on, applications will be possible. We assume that there will be a delay of only a few days between the submission of an application and the payment of contributions by the Labor Office. For the month of March, the employer will therefore submit an application at the beginning of April.

To qualify for compensation will need to meet several conditions:

- The employer strictly adheres to the Labor Code

- Obstacle to work arises as a result of COVID-19 contagion

- The employee must not be dismissed

- It concerns companies in the business sector, employees must be in employment and participate in sickness and pension insurance

- The employer must pay the wage / salary and pay the contributions

MODE A: State contribution to employer will be 80% of wage compensation paid by employer to to employee, including contributions (social security, health insurance). However, up to a maximum of CZK 39,000 per employee.

MODE B: State contribution to employer will be 60% of wage compensation paid by employer to to employee, including contributions (social security and health insurance). However, up to a maximum of CZK 29,000 per employee.

To be eligible for the Antivirus Program, you must submit an application. The application form is filled in via the web application: https://antivirus.mpsv.cz. If you need help filling in and submitting an application form, please contact us.

Application including agreement and other documents is submitted by the employer to the relevant workplace according to its registered office (via data box or email with a recognized electronic signature). For administrative simplification, an agreement to provide a contribution from the targeted Antivirus program is generated when the application is created. The agreement is concluded if it is electronically signed by the Labor Office and sent back to the employer through the same channel as it was delivered (data box, e-mail).

Thereafter, the employer is obliged to fill in the cost statement of wage compensation (billing) separately for each month. The monthly billing in the form of PDF file (s) and attached XLSX file is sent electronically via data box or by e-mail with a recognized electronic signature. The employer is obliged to deliver the billing no later than the end of the calendar month following the end of the reported monthly period. Billing template: https://antivirus.mpsv.cz/vyuctovani.

| Antivirus - Employer Manual | |||

| REQUIRED DOCUMENTS | APPLICATION | BILLING | CHECK (FOLLOW-UP) |

| Identification data | The existence of an employment relationship | The Labor Office of the Czech Republic will ensure a consistent continuous, but especially follow-up inspection. | |

| The person's authority to represent employer | Affidavit - compensation paid and made contributions | During the inspection, the employer will prove especially: | |

| Proof of bank account | Affidavit - the existence of an obstacle to work and its duration | * Employment contracts, * Internal rules governing obstacles to work, agreements with trade unions authorizing to pay a reduced wage compensation in accordance with the LC, * Order quarantine employees, obstacle to work as a result of childcare, * Payroll and attendance records proving the emergence of obstacles to work and the payment of the relevant wage compensation in accordance with the LC, *Statements of accounts showing the payment of wage compensation employees and payment of levies,* in the event of downtime (Section 207 (a) of the LC) or Partial unemployment (§ 209 LC) the employer will also submit documents proving the termination of orders, reduction of sales, restrictions on transport, etc., ie, the fact that there was actually an obstacle to work on the part of the employer. |

|

| Affidavit - paid wages that are subject to billing, not covered by other public budgets | |||

| The affidavit is part of the bill, by confirming the bill (electronic signature, inserting into the data box) the employer automatically signs the affidavit. | |||

| In case of Mode A, the relevant crisis measure (government resolution), resp. extraordinary measure of the Ministry of Health or of the Regional Hygiene Station, according to which he was forced to close operations or restrict its activities. The employer shall give only the number of the relevant document. | |||

6) The Care Benefit

The following rules apply during school closure due to Covid-19:

If the employees have children <13 years old (handicapped children attending school without age limitations), whose schools have been closed, one of the parents has the right to:

- no work

- reduced salary compensation provided by Social Security Office (i.e. no contribution of employer) – special formula is applied(The basis for calculating The Care Benefit is the average daily income for the relevant period. This is further regulated according to the Sickness Insurance Act by means of three reduction limits, thus obtaining the so-called reduced daily assessment base. The Care Benefit is paid for calendar days (from day one) and is 60% of the reduced daily assessment base)

- The care benefit for employees will be reimbursed as long as there are closed schools and other similar facilities.

- It is now possible for carers (mostly parents) to take turns in care more than once, and the number and manner of such turns is unlimited.

Upon the closure of a facility designed for the care of handicapped persons, there is also a claim to the care befit without age restriction of the handicapped person.

Even if the founder decides to close the facility due to an epidemic, the employee is entitled to the care benefit.

How to apply?

- The parent receives a form from the school facility, which he / she will fill in and sign (part B in the document) and transmit or electronically send (photo, scan the form) to his / her employer.

- Application form: HERE.

- The employee applies for the payment of the care benefit with the Application form for nursing care for a child up to 10 years of age due to the closure of the educational facility (school), which will issue the educational facility (school) in which the child attends.

- Part A. of the form fills the school / other facility

- Part B of the form is completed by the parent

- electronically received form from the school / other facility the parent can without undue delay forward the technically appropriate way (by e-mail) for information to their employer (as proof of obstacle at work - "excuse")

- however, in order to apply for a nursing allowance, the parent must complete, sign and send the electronic form sent by the school, either:

- completely electronically, if it has the technical means (qualified electronic signature),

- however, if the parent (applicant) does not have an electronic signature, he / she can print, fill, sign, scan (or take a picture) and send it electronically to the employer by e-mail,

- or may print, complete, sign and hand over the form physically to the employer.

- IMPORTANT: the day from which the parent will request the care has to be indicated by the parent in Part B - If the parent does not mark the, the day indicated on the form as the day of closure of the child / other facility will be considered as the beginning of the support period.

- Part C of the form shall be completed by the employer

-

- electronically delivered application form from an employee an employer submits electronically to the DSSA together with documents for calculating the benefit, ie either with an electronic signature or a data box (to the address of the electronic registry),

- or physically delivered and signed form with documents for calculating the benefit sent to DSSA by post

-

- It is also necessary for an employee to hand over the form “Statement of childcare due to the closure of an educational institution” to the employer at the end of each calendar month. In this form, he / she will fill in the days in which he / she took care of the child. It must therefore be clear when they were at home with children or the disabled and when they went to work.

Application form: HERE

Notes:

- If one parent receives a parental benefit or maternity benefit, the other parent may receive the care benefit for the other child. However, it is not possible for the same child to receive a parental benefit (mother) and the care benefit (father).

- The caregiver can receive only one benefit per household. It doesn't matter how many children you care for.

- Any person other than parents can apply for the care benefit if they live with child in the same household and participate in sickness insurance (employment, not agreements).

- Only employees for whom the employer pays the insurance are entitled to the care benefit.

Follow our website and contact us if you need professional assistance.

Covid-19: 劳动关系表 - 新冠病毒

| 劳动关系表 - 新冠病毒 | ||

| 员工必须做防护隔离 | § 191 和 192 劳动法 -员工方面的障碍 | 前14个日历日 - 工资补偿 60% 平均收益减少, 从第15个日历日开始 - 疾病津贴 (国家支付的疾病津贴).(根据政府计划*, 如果满足要求, 国家支付给雇主的工资补偿将为80%). |

| 该员工因病暂时无法工作 | § 191 和 192 劳动法 -员工方面的障碍 | 前14个日历日 - 工资补偿 60% 平均收益减少, 从第15个日历日开始 - 疾病津贴 (国家支付的疾病津贴). |

| 由于学校设施关闭员工必须照顾13岁以下的孩子 或没有年龄限制的残疾儿童上学 | 员工方面的障碍 | 社会保障局提供的工资补偿 (OSSZ) (即无雇主供款) -每日评估基础的60%. 护理福利将在紧急措施之日追溯支付。 |

| 由于关闭了残疾人设施 员工必须照顾残疾人 | 员工方面的障碍 | 社会保障局提供的工资补偿 (OSSZ) (即无雇主供款) - 每日评估基础的60%. 护理福利将在紧急措施之日追溯支付。 |

| 因为30%的员工不上班 (检疫, 保育) 未能将工作分配给其余员工 | § 208 劳动法 - 雇主的障碍 | 工资补偿为平均收入的100% ( 根据政府计划*, 如果满足要求, 国家支付给雇主的工资补偿将为60%) |

| 由于输入中断(原料供应, 服务, 组件, 文件) 未能分配工作 | § 207 a) 劳动法 - 雇主的障碍 | 工资补偿为平均收入的80% ( 根据政府计划*, 如果满足要求, 国家支付给雇主的工资补偿将为60%) |

| 由公共卫生保护部门采取特殊措施(关闭一个城市) 暂时关闭或限制运营 | § 191 and 192 劳动法 - 员工方面的障碍 | 前14个日历日 - 工资补偿 60% 平均收益减少, 从第15个日历日开始 - 疾病津贴 (国家支付的疾病津贴). (工资补偿的条件是将已检疫的文件交付社会保障局) |

| 由于根据《危机法》采取了紧急措施 ( 与政府决议有关 - 健身房, 服装店, 饭店) 暂时关闭或限制运营 | § 208 劳动法 - 雇主的障碍

但:如果需求/销售受到限制,并且与工会达成协议 或发布内部法规, 雇主将有权降低雇员的工时 |

工资补偿为平均收入的100% (根据政府计划*, 如果满足要求, 国家支付给雇主的工资补偿将为80%)

工资补偿至少为平均收入的60% |

| 暂时关闭或限制运营 对提供的服务需求减少的结果 或产品销售减少 | § 208 劳动法- 雇主的障碍

但: 与工会达成协议或发布内部法规, 雇主将有权降低雇员的工时 |

工资补偿为平均收入的100%

工资补偿至少为平均收入的60% |

| 在家办公 | § 317 劳动法 - 上述情况中根据工作性质,可能的情况下应在家工作 | 已完成工作的工资 经过检疫已被定为新冠患者必须进行隔离防护的人员也可以在家工作. |

| *雇主什么时候可以要求赔偿? 月末工时总结报告完成后,雇主将要求退还已付的工资补偿金, 即在日历月结束之后. 对于3月份,雇主将在4月初提交申请。 详细信息将在下周发布。如果您需要专业帮助,请与我们联系。 |

||

Covid-19: Table of labor relations

Table of labor relations - the fight against coronavirus |

|||

| Employees were ordered into quarantine | § 191 and 192 LC - important personal obstacle to work on the part of the employee | For the first 14 cal. days - wage / salary compensation of 60% reduced average earnings, from the 15th cal. day - sickness benefit (sickness benefit are paid by the state). According to the approved Targeted Employment Support Program*, wage compensation paid to employers will be 80%. | Mode A program |

| The employee was temporarily unable to work due to illness | § 191 and 192 LC - important personal obstacle to work on the part of the employee | For the first 14 cal. days - wage / salary compensation of 60% reduced average earnings, from the 15th cal. day - sickness benefit (sickness benefit are paid by the state) | - |

| The employee must take care of a child under the age of 13 (handicapped children attending school without age limitations) due to the closure of the school facility | Important personal obstacle to work on the part of the employee | Reduced salary compensation provided by Social Security Office. The Care Benefit is paid for calendar days (from day one) and is 60% of the reduced daily assessment base) | - |

| The employee must take care of a handicapped person because the facility designed for the care of handicapped persons is closed | Unnamed other important personal impediment to employee work | Reduced salary compensation provided by Social Security Office. The Care Benefit is paid for calendar days (from day one) and is 60% of the reduced daily assessment base) | - |

| Failure to allocate work to the remaining employees due to the absence of more employees (e.g. quarantine, childcare) - 30% of employees |

§ 208 LC - other obstacle to work on the part of the employer | Wage / salary compensation of 100% average earnings (According to the approved Extended Employment Support Program*, if the requirements are met, wage compensation paid to employers will be 60%) | Mode B program |

| Failure to allocate work due to input outages (supplies of raw materials, services, components, documents) | § 207 let. a) LC - obstacle to work on the part of the employer (downtime) | Wage / salary compensation of at least 80% average earnings (According to the approved Extended Employment Support Program*, if the requirements are met, wage compensation paid to employers will be 60%) |

Mode B program |

| Temporary closure or restriction of operations as a result of extraordinary measures taken by the public health protection authority (eg closure of a municipality) |

§ 191 and 192 LC - important personal obstacle to work on the part of the employee | For the first 14 cal. days - wage / salary compensation of 60% reduced average earnings, from the 15th cal. day - sickness benefit (sickness benefit are paid by the state). (The condition for wage / salary compensation is a confirmatory document quarantine orders delivered to the relevant DSSA) |

- |

| Temporary closure or restriction of operations as a result of emergency measures taken under the Crisis Act (eg in connection with government resolutions - gyms, clothing stores, restaurants) |

§ 208 LC - other obstacle to work on the part of the employer

BUT: if demand / sales are limited and an agreement is reached with a trade union or an internal regulation is issued, partial unemployment can be applied |

Wage / salary compensation of 100 % average earnings (According to the approved Targeted Employment Support Program*, if the requirements are met, wage compensation paid to employers will be 80%)

Wage compensation of at least 60% average earnings |

Mode A program |

| Temporary closure or restriction of operations as a result of a reduction in demand for services rendered or a reduction in product sales | § 208 LC - other obstacle to work on the part of the employer

BUT: an agreement is reached with a trade union or an internal regulation is issued, partial unemployment can be applied |

Wage / salary compensation of 100 % average earnings

Wage compensation of at least 60% average earnings |

Mode B program |

| Homeoffice | § 317 LC - if it is possible with regard to the nature of the work performed, it is possible to agree on work from home in the above situations | Wage / salary for work performed Doing work from home, if the conditions are met, can also be held in quarantine. |

- |

| *When should the employer claim compensation? Implementation of the support is set so that the employer will ask for a refund of the paid wage compensation after the end of the reporting period, ie after the end of the calendar month for which it will apply for the contribution. For the month of March, the employer will therefore submit an application at the beginning of April. Mode A: State contribution to employer will be 80% of wage compensation paid by employer to to employee, including contributions (social security, health insurance). However, up to a maximum of CZK 39,000 Mode B: State contribution to employer will be 60% of wage compensation paid by employer to to employee, including contributions (social security and health insurance). However, up to a maximum of CZK 29,000 Follow our website and contact us if you need professional assistance. You can find more detailed information in this article on our website: https://va-legal.cz/covid-19-state-measures-and-employees-employers/ |

|||

Certificate of the force majeure intervention

Assistance of Czech Chamber of Commerce in the issue of CERTIFICATE OF THE FORCE MAJEURE INTERVENTION in times of emergency caused by the COVID-19 pandemic.

- What is a force majeure certificate - a certificate stating that a company was unable to meet its contractual obligations, which may be subject to sanctions in favor of the contractor because it was prevented from doing so by circumstances beyond its control or averted; occurred independently of her will, such as floods and other natural disasters, war, strike, accidental accident, etc. The certificate can be used to notify the business partner, or even judicial and mediation proceedings.

- Who can apply for a certificate - the certificate can be issued to an applicant who is registered in the statutory register (eg a Czech company, a branch of a foreign company) who has a contractual relationship with a foreign entity.

- Who can issue a certificate of force majeure - only the Economic Chamber of the Czech Republic is entitled to issue a certificate of force majeure - contact: certifikáty@komora.cz. After sending your order, you will be contacted to specify the required documents and information to issue a certificate of force majeure.

- What documents do I need in order to prove force majeure - in the order in the note category - it is necessary to give a brief description of the event or fact, which the applicant wants to confirm by force majeure certificate. In specific situations, it will be necessary to provide contractual documentation that demonstrates the contractual relationship. It will always be necessary to assess each case on a case-by-case basis whether the emergency measures proclaimed by the government were affected

- What confirmation do I need to prove force majeure - the declaration of a state of emergency or restriction of movement is ordered by a government resolution. A government resolution or at least the number of a specific resolution (depending on which prohibition has resulted in a failure to fulfill contractual obligations) may be attached.

- Price of the certificate - the issue of the certificate is charged. Up to 50% discount for force majeure certificates is provided as part of the emergency declaration. With regard to the personnel capacity of the HK ČR Office, force majeure interventions are issued only within 7 or more than 7 working days. Price list (all prices are without 50% discount):

Certificate issued within 7 working days Certificate issued over 7 working days variant A variant B variant A variant B Certificate of force majeure in the Czech language 5 000 Kč 7 000 Kč 4 200 Kč 6 000 Kč Certificate of force majeure in foreign language 8 000 Kč 10 000Kč 6 000 Kč 8 000 Kč

- Variant A includes a certificate of one fact.

- Variant B includes certification of two or more facts.

- Certificates in a foreign language are issued in English; or in languages notified at the Ministry of Foreign Affairs of the Czech Republic (according to the current language competence of the authorized person).

- The deadlines for issuing the certificate shall be calculated from the next working day following the submission of the last document required by the applicant.

- Certificates shall be drawn up in two copies for one case. 20% of the price determined according to the above principles is charged for each additional copy.

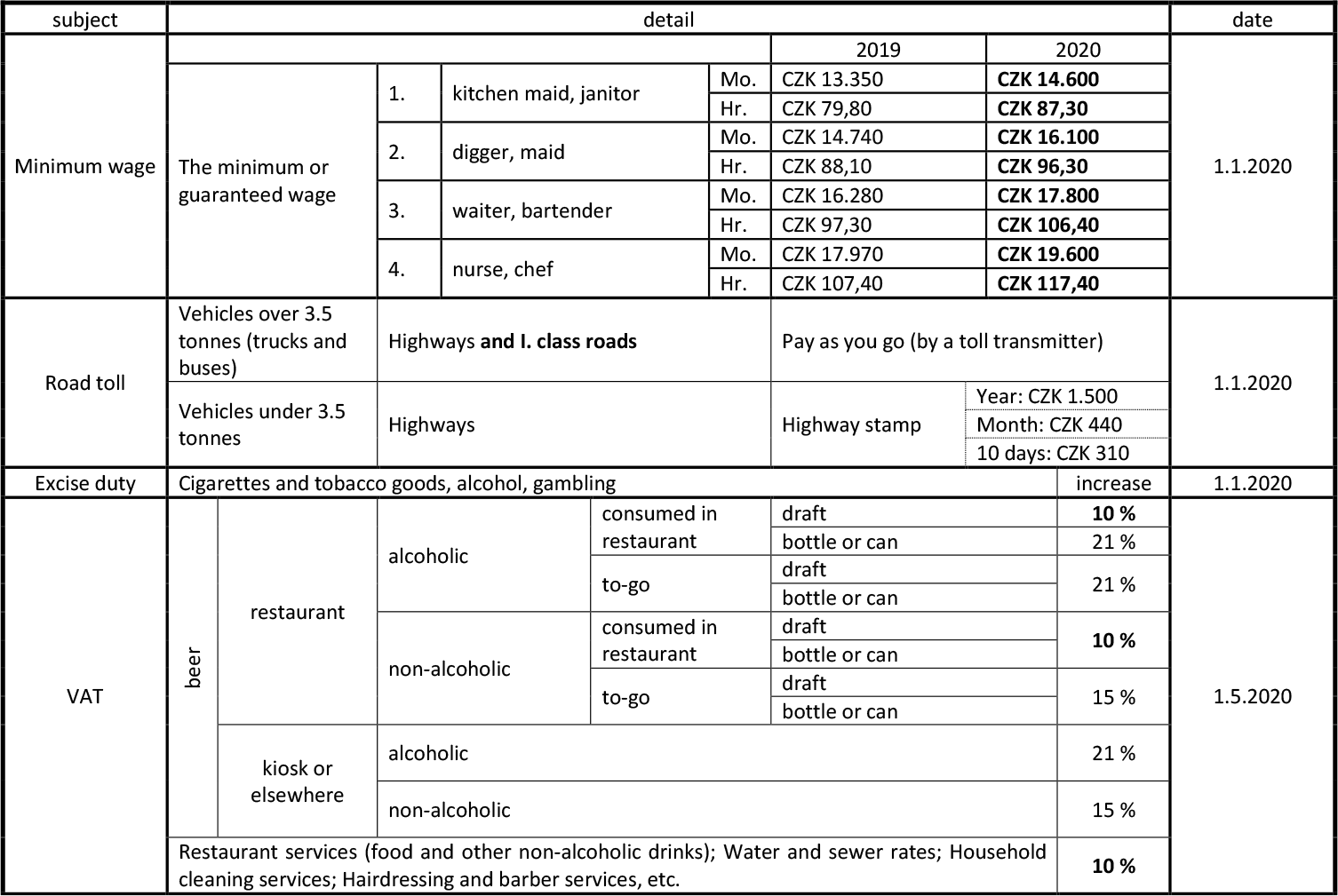

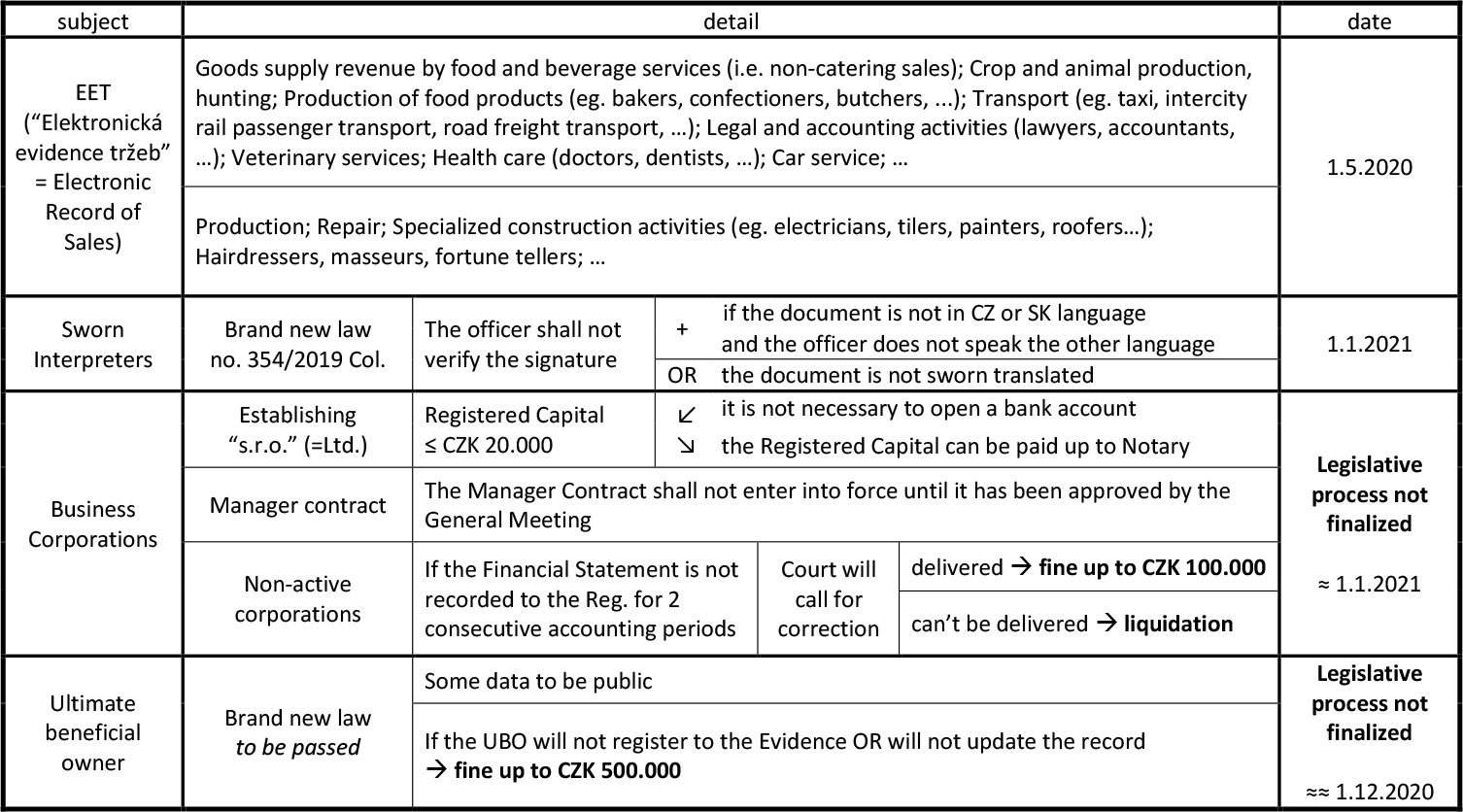

Brief summary of legislative changes in 2020

We offer a brief summary of legislative changes in 2020 that will affect all of us, both Czech citizens and foreigners. For more information please contact our law office.